Pondering over Facebook’s Libra

In 2019 Facebook announced Libra (a), a new payment network to be launched in the near future. FB plans to not only create a cheaper alternative to the payments industry, but also build it on an entirely new currency — which will also be called Libra.

Bootstrapping an entirely new global payment network is quite an undertaking. To do that while also creating a new currency would be an astonishing feat. It would involve overcoming hard chicken-and-egg challenges, strongly-seated incumbents, geopolitics, and so on.

Here are the questions that have come to mind as I ponder over Libra, its apparent strategy, and the challenges ahead:

Does Libra have any actual competitive advantage? What FB brings to payments that could allow them to somehow leapfrog the incumbents?

How to deal with governments? The Libra Reserve system is a monetary and fiscal attack on governments. What is Libra’s strategy to lure them?

What are the incumbents doing there? Mastercard and Visa are joining Libra as founding members. How come?

Should anyone believe the cryptocurrency hype? Why is FB framing Libra as a blockchain-based cryptocurrency?

What if it works? If we time travel decades into the future, what is the best-case scenario for Libra?

1. Does Libra have any actual competitive advantage?

What FB brings to payments that could allow them to somehow leapfrog the incumbents?

Facebook will certainly seek to leverage the reach of mobile phones to grow the Libra. Mobile chat apps — WhatsApp, Messenger, and others — have spread out across the globe and now reach a far wider audience than the current banking and payment systems.

Chat apps can be exceptional channels for distributing the Libra, but I don’t think that alone is enough for it to succeed. Building a new payment network that seeks to reach beyond current ones comes with at least two hard-to-crack nuts: (1) compliance to governmental regulations and (2) proper management of transaction disputes.

To put it simply, compliance to regulations encompasses know your customer (KYC) and anti-money laundering (AML) procedures. Governments require them as a way to cope with criminals. It’s lots of checkpoints and paperwork — e.g. documents proving customer identities, forms with the origin of their funds, etc.

The other hard-to-crack nut is about disputes. As anyone with a credit card knows, things often go sideways in real-world transactions, causing disputes to arise. For instance, some transactions may need to be canceled; refunds may be requested; fraudsters may spend your money; and so on. Management of disputes is the set of processes and systems that includes customer support, legal-related work, and much more. These are unsexy yet essential ingredients of payment systems.

I could not find relevant information about how Libra plans to tackle these challenges. They are too vague in their white paper (a). There, they simply state that “[we will be] innovating on compliance and regulatory fronts to improve the effectiveness of anti-money laundering.”

In its launch website, Facebook says Libra will target the underbanked in lower income countries. If that is the plan, cost-efficiency will be critical, and the question then becomes: Can Libra handle regulation and disputes efficiently enough to keep costs much lower than incumbents?

Given the lack of information on Libra’s strategy, it might be informative to examine how Bitcoin addresses these two nuts (sidenote: One could say Bitcoin is not your usual payments network. After all, it is, strictly speaking, just self-contained software and computing resources.

That might also be the whole point of why Bitcoin can be so disruptive. It clearly is an asymmetric competitor to existing solutions.) .

Bitcoin’s solutions are radically simple: it ignores all governmental regulations and user disputes. If you own and control your private keys, there is no one to sue nor anyone to ask for regulatory compliance. Disputing transactions in Bitcoin is impossible, because, by design, transactions are final.

In other words, the responsibility of protecting against fraud and plugging to existing KYC-AML systems is left to users themselves — or to the third parties users eventually hire, like Coinbase, Ledger Wallet, etc.

At the end of the day, unlike Bitcoin, Libra seems to be a bet that it is possible to comply with governmental rules while also being much cheaper than payment incumbents.

I find it hard to believe that the Libra could be successful unless they come up with something very smart to tackle the two nuts. One possible strategy would be to reach massive end-user adoption as fast as possible and then leverage it to lobby for regulatory changes. This is from Uber’s playbook, but could that work in payments?

Facebook surely knows that cracking these nuts is a crucial. They must be working on something and I am curious to find out what they come up with.

2. How to deal with governments?

The Libra Reserve system is a monetary and fiscal attack on governments. What is Libra’s strategy to lure them?

For every unit of Libra circulating, Libra says there will be a correspondent 1-to-1 reserve denominated in a basket of low-volatility, low-inflation currencies — likely the dollar, euro, and other similar fiat currencies. Their monetary policy will thus resemble the gold standard era, in which countries held gold bars as a guarantee that the national currency they issued had any value.

The obvious challenge about monetary policy is the following. If Libra is successful, say, in Brazil, then citizens will rely on a currency that is not controlled by their national central bank. No sane state will give up on their existing monopoly on domestic currency without getting something absurdly good in exchange.

In other words, if a government monopoly on currency breaks apart, fundamental issues (and maybe even the national states themselves) would need careful rethinking. Things like taxes, government funding, and interest rates would need to be reexamined.

Is it possible for Libra to make an offer that any given government could not refuse? I cannot think of anything.

If no acceptable offer seems viable, then the question is: What is, after all, Libra’s strategy on this front? Speed? Deception? Something else?

By speed I mean, could Libra move to spread faster than governments’ reaction time? Will governments be that slow to act about something so “dangerous”? Deception would be the Libra avoiding any frontal attack. If that is the strategy, then what kind of sheep’s clothing could Libra wear to deceive a national government?

3. What are the incumbents doing there?

Mastercard and Visa are joining Libra as founding members. How come?

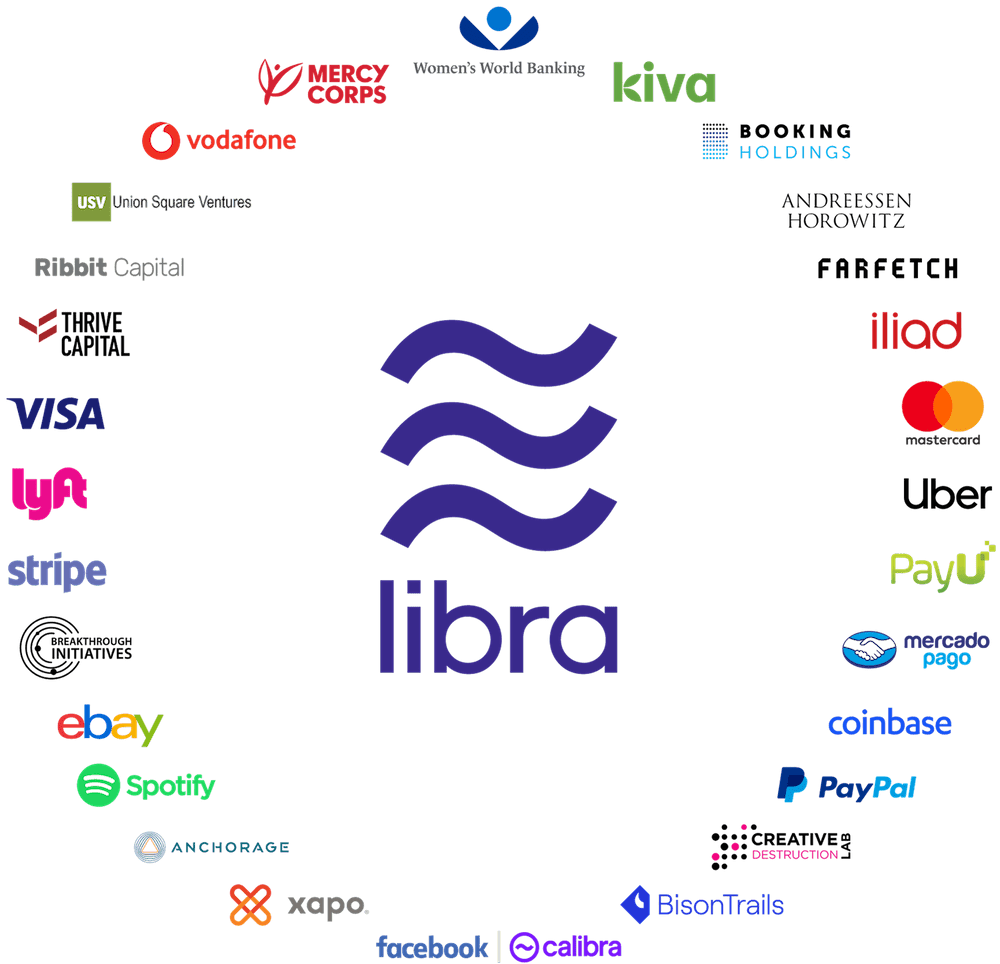

Let’s take a look at the initial group of founding members of Libra Association (sidenote: Update — June 2021

It is clear that the Libra Association (now rebranded as Diem Association) was designed after the original Visa network.

Marc Rubinstein explains it well (a):

“[Facebook] recruited 28 organisations from different industries to form the Libra Association. The association would be a not-for-profit in the mould that Dee Hock first envisioned when he set up Visa over sixty years ago (a). And just as Bank of America agreed to seed Visa in anticipation of capturing a small piece of a larger, open network, Facebook thought the same about Libra. It would sit on top of the network with its wallet Calibra, now called Novi, in the same way Bank of America cards sit on top of the Visa network.”) . What kind of short- and mid-term incentives do they have?

It is evident that Internet-based businesses, especially marketplaces like Uber and eBay, would benefit a lot from cheaper and widespread payment systems. One of the challenges to their continued growth is the lack of seamless payment solutions in poorer countries. The alternative to seamless payments is cash, which is harder to scale; involves more frauds; makes the user experience worse; and so on. Even in richer countries, if something cheaper than the current credit card fees existed, it would reduce their costs of doing business. So one can easily understand why Internet-based companies are supporting the Libra. No surprises there.

The fact that venture capital firms, like a16z and USV, are part of the initial group seems very reasonable as well. Simply put, they are in the business of making very-out-the-money bets that could become huge, if correct.

I find quite puzzling though that Visa and Mastercard are also said to be joining the Libra Association. I could not come up with a compelling explanation for that.

Are such powerful incumbents really helping kickstart a potential disruptor?

My best (yet admittedly dull) guess is as follows. Visa and Mastercard are joining in as a defensive move. They will try to steer the Libra far from their profitable, existing businesses. Maybe by keeping it focused on the unbanked for the foreseeable future.

4. Should anyone believe the cryptocurrency hype?

Why is FB framing Libra as a blockchain-based cryptocurrency?

For starters, it is debatable if Libra is a cryptocurrency in the first place.

Even if we concede that it intends to use technologies similar to Bitcoin and Ethereum, Libra will not be an open network. It says it plans to become more open in the future, but who knows?

It also is not clear from the Libra Blockchain technical paper what type of control end users will have over private keys. If there is no exclusive control over a private key, then there is no real ownership of anything that is based on asymmetric cryptography.

The best theory that I have for why they are positioning themselves as a cryptocurrency is to surf the zeitgeist, especially with software engineers. They seem interested in attracting developers’ goodwill and (ideally free) contributions.

It feels similar to the open-source playbook that many tech companies have applied to parts of their recent launches with “platform” ambitions — think of Google’s TensorFlow, Apple’s Swift, Facebook’s React, etc.

5. What if it works?

If we time travel decades into the future, what is the best-case scenario for Libra?

The best possible outcome for Libra is becoming the de facto universal currency. This is a wildly speculative idea, but in the future, a new currency could make today’s US dollar look small.

Over a long enough time scale, it is plausible that some currency could be more universal than the US dollar is nowadays. If that happens, I have no idea though if it will be the Libra, the Chinese Renminbi, Bitcoin, or something else.

In any case, with the emergence of a universal currency or not, software will continue its “attack” on money. And, as the saying goes, constant dripping of water wears away the stone…

July 2019